What is tokenization? Token-economy 101

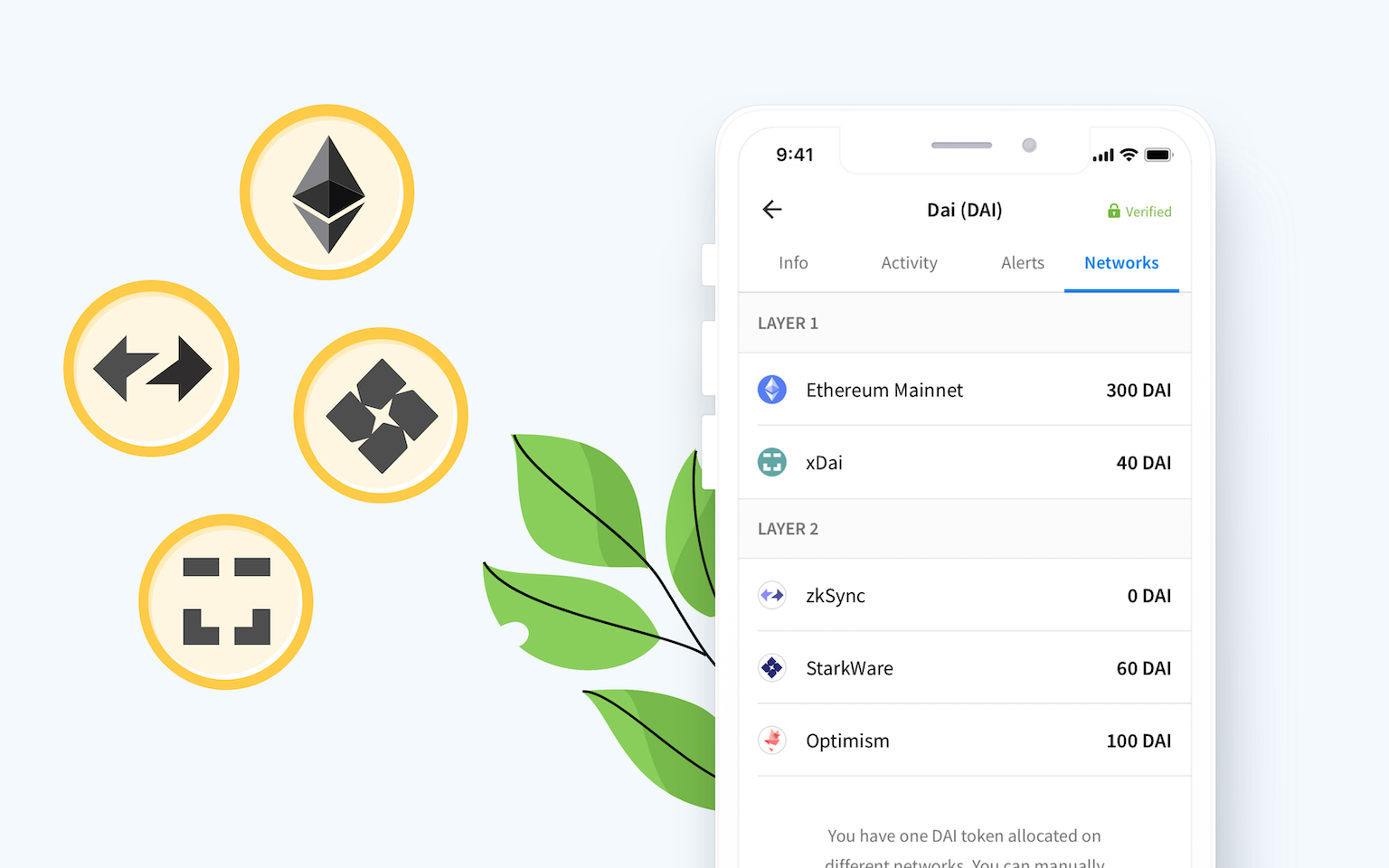

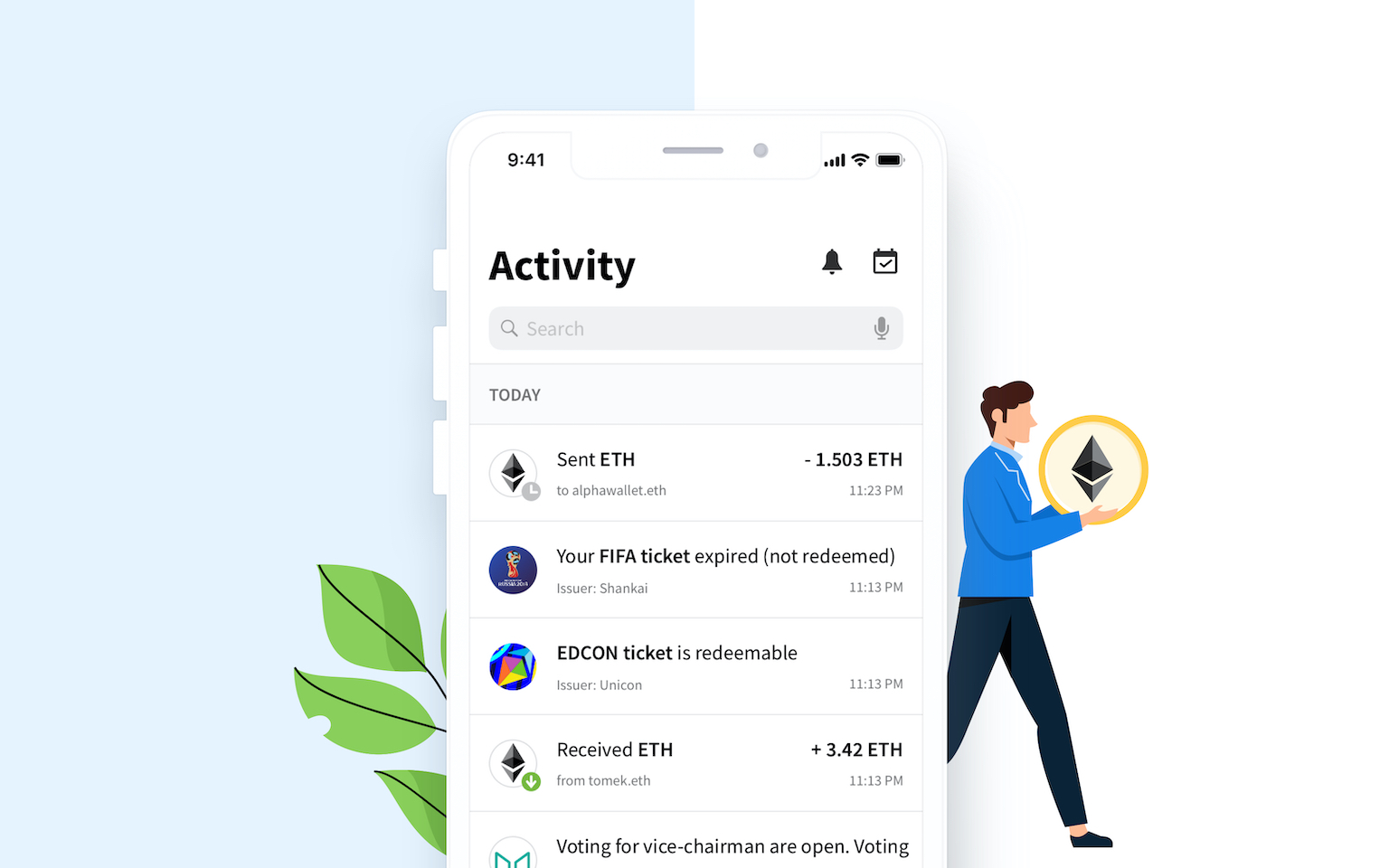

At AlphaWallet we do things with Tokens.

When I faced an opportunity to explain what “Tokenization” (TokenScript) to a group of barrister dining casually outside of the state Supreme Court, I went ahead with a “legal” narrative, starting by defining Token:

“Token”, I said, “is a stake in a smart contract”.

It is not very different than a traditional contract which may or may not have ink signatures. Visualise a subway token, this one:

It is a token that represents your stake in the ship-me-to-my-station contract. It isn’t signed by ink, but, instead, contractualised by the purchase of a subway token. The execution of such a contract can be summarised as:

𝑎) you the user holds of such a token; and

𝑏) a computer (in this case a turnstile) provides you with an action (it opens).

The scenario is not different than that of crypto-tokens, except:

𝑎) The crypto-token is in your crypto-wallet, not in your hands;

𝑏) The computer, in this case, is the global Ethereum computer plus any connected systems regarding it as the source of truth.

Subway Token

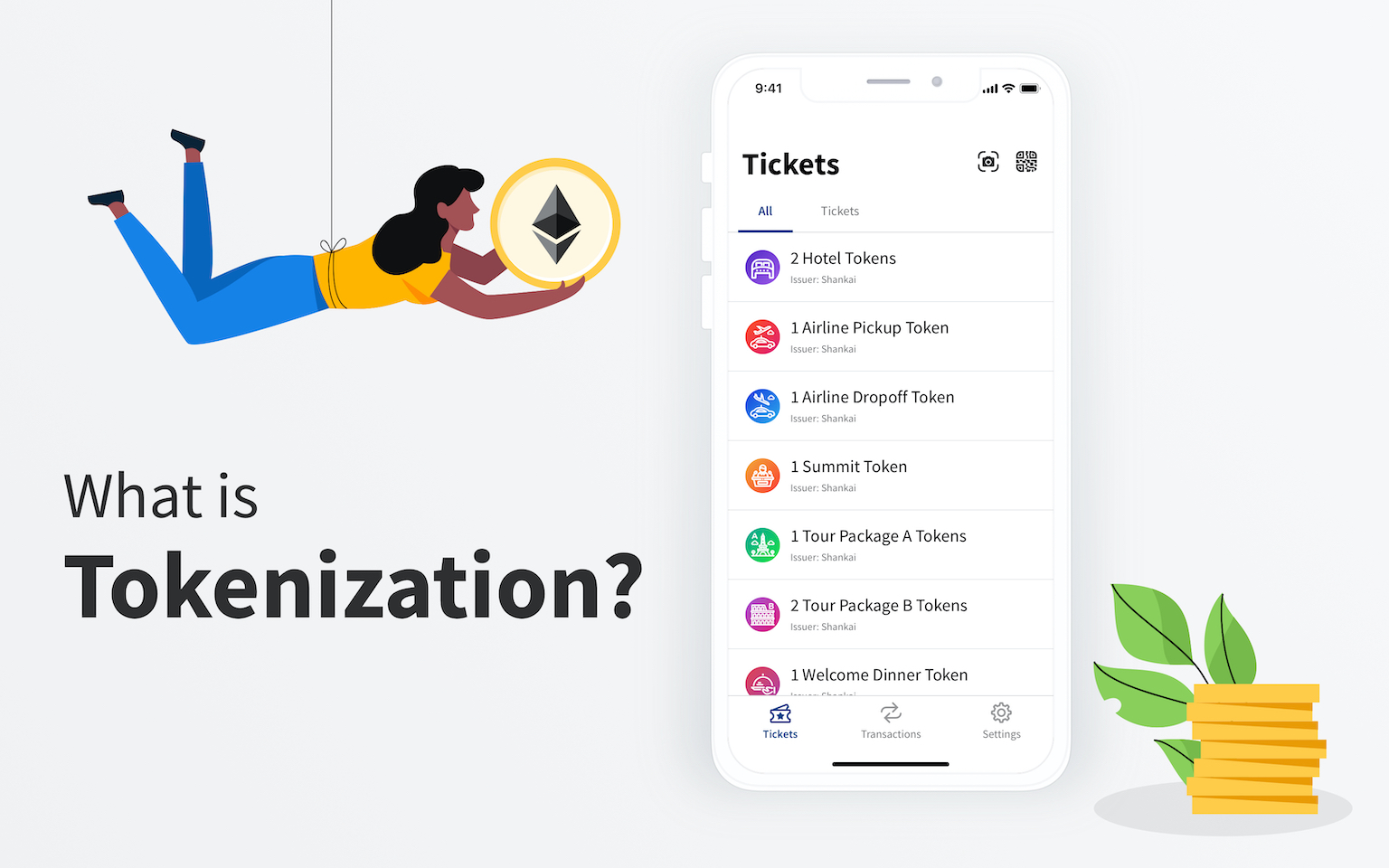

We used the subway token as an example. In fact, all tickets — be it train ticket, plane ticket, Disney land ticket — are tokens. They are both a token of the contractual relationship and an authentication mechanism which service providers act on. They serve such function in paper form or crypto form.

The concept of a token as a representation of the stake in a contract that enables a contract to execute is nothing new. According to the movie John Wick 3 Parabellum, John Wick has quite a few of them. In every pivotal moment, John would produce a token and force some badass bosses to commit to the previously agreed contract.

This definition of Token as a stake in the smart contract might look like a deviation from the ICO tokens, but ICO tokens are stakes in the contract nonetheless. People often compare ICO token to casino chips which you can use to buy stuff with or acquire fractional ownership of something. Casino chips do represent a stake in the contract, a contract that says you can play the slots. We just don’t often realise it. Fractional ownership tokens, like many which were invented to represent fractional ownership of a property, apparently, is also a stake in a contract.

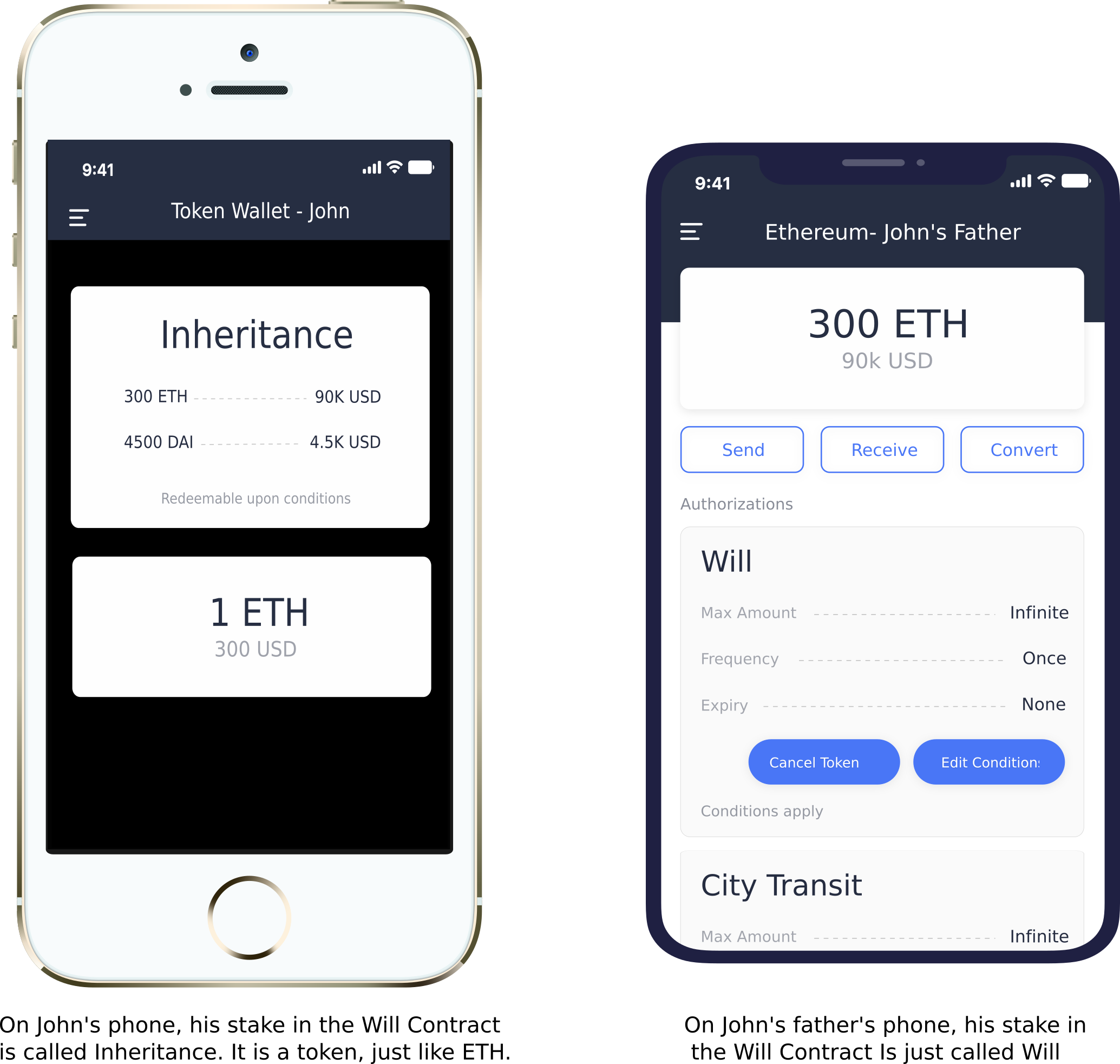

But sometimes a stake of a contract isn’t easily visualised as a token. Imagine that our John, the token holder, has a millionaire father with a will in the form of a smart contract. John’s identity, represented by a blockchain address, is in that contract; therefore, John has a stake in that contract. Is it a token? Let me visualise it for you. Such a token will probably look like this in John’s wallet:

Like every other token, John can do things with it as long as the smart contract (and connected systems) allows. For example, he can collateralise it for a loan. I’m not suggesting it’s the right thing to do, but he can do that as long as smart contract rules allows it. He can create a lottery out of it. Again it may sound dodgy, but as long as smart contracts are functioning and you read the contract’s Caveat Emptor, you can safely buy such a token.

Let’s examine a real example: The throne of king ether. This contract was created in early 2016, and anyone can take a stake as long as they pay the needed sum. The game rule is simple: you pay to the contract more than the current guy on the throne, by doing so taking the throne. You get rewarded when someone else takes the throne from you. His wage becomes your profit.

In this case, the token, as a stake of the contract, can’t be clearer — it even has a name: the throne. The throne is a token. (As everybody already knows, any throne is but a token.)

What are the benefits of tokenisation?

My lawyer friends, having listened to this dramatic conceptualisation, and not seemly entertained, asked:

Now that we learned Tokenisation, why is it needed at all? It’s not like that the court wouldn’t recognise or enforce a contract if it’s not tokenised.

The candidate answers popular on the Internet include “Courts are for the rich to ridicule at the poor”, “Laws are made by white slave owners and sneering imperialists”, “Lawyers are blood-sucking parasites”, “Humanity has fallen. We need to replace tyrants with machine overlords” and so like. But those wouldn’t be my view on the power of Tokenisation. I answered:

Well, Tokens are like building blocks. It allows us to build things.

If we do not model John’s inheritance as a token but leave it as a smart contract obligation, then it’s difficult to build stuff like collateralisation or creation of lottery on top of it in an object-oriented way. It would also be difficult to set up automatable trading rules around it. If you do not like the idea of tradable inheritance (naturally, it begets crime), there are other tradable tokens, like a life-insurance token, to be built on top of it. You can also build a reverse life-insurance: one gets rewarded if he manages to keep your dad alive and healthy — and float it for trading, and there will be lots of people who care about his health.

The throne of the Ether King can also be made tradable if tokenised. In fact, had the original Thorne of the Ether King contract been created with tokenisation in mind, it would have been interesting to see how people speculate the price of the throne or form parties around its pursuit, turning it into a Game of The Throne.

Game of the Throne

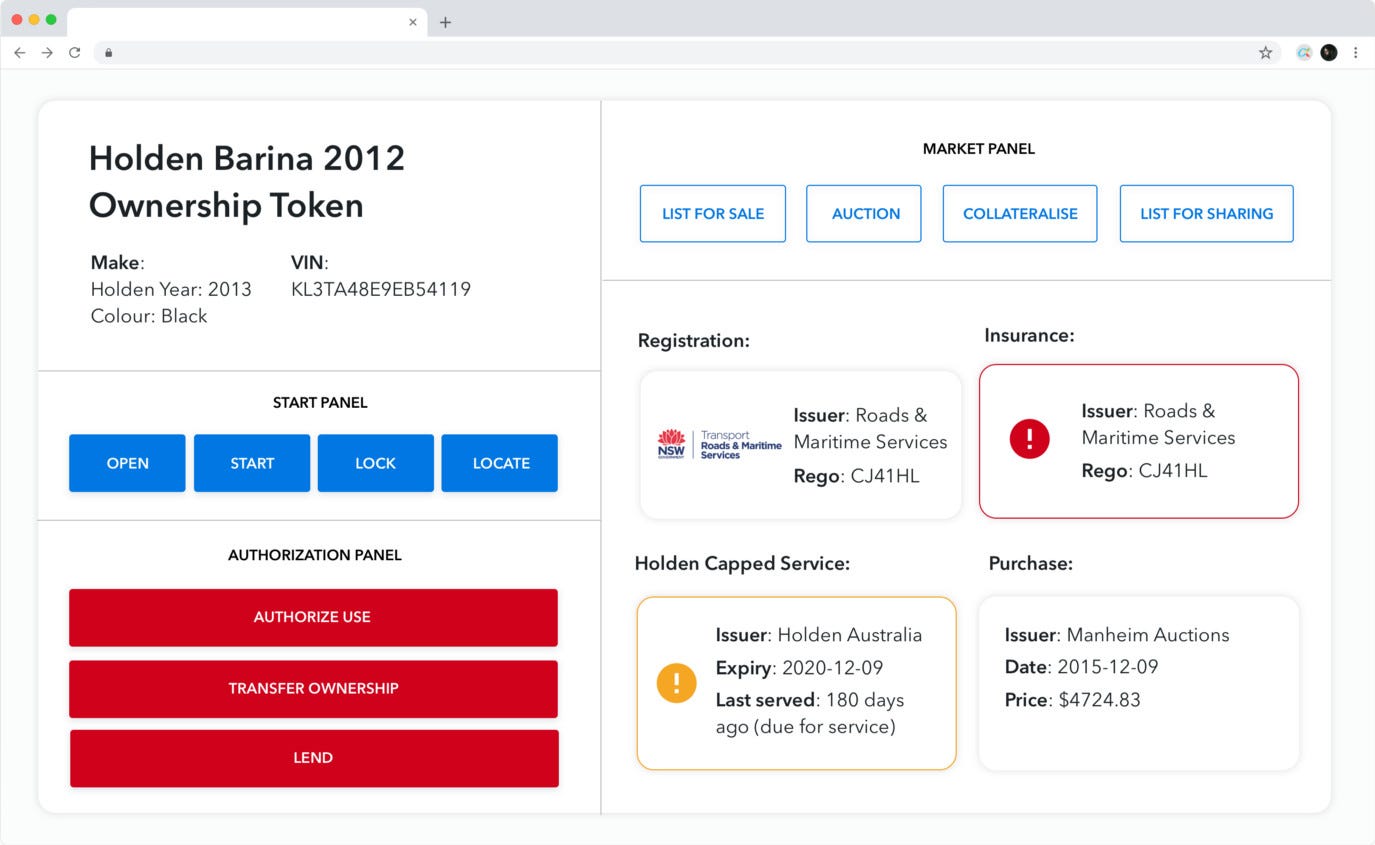

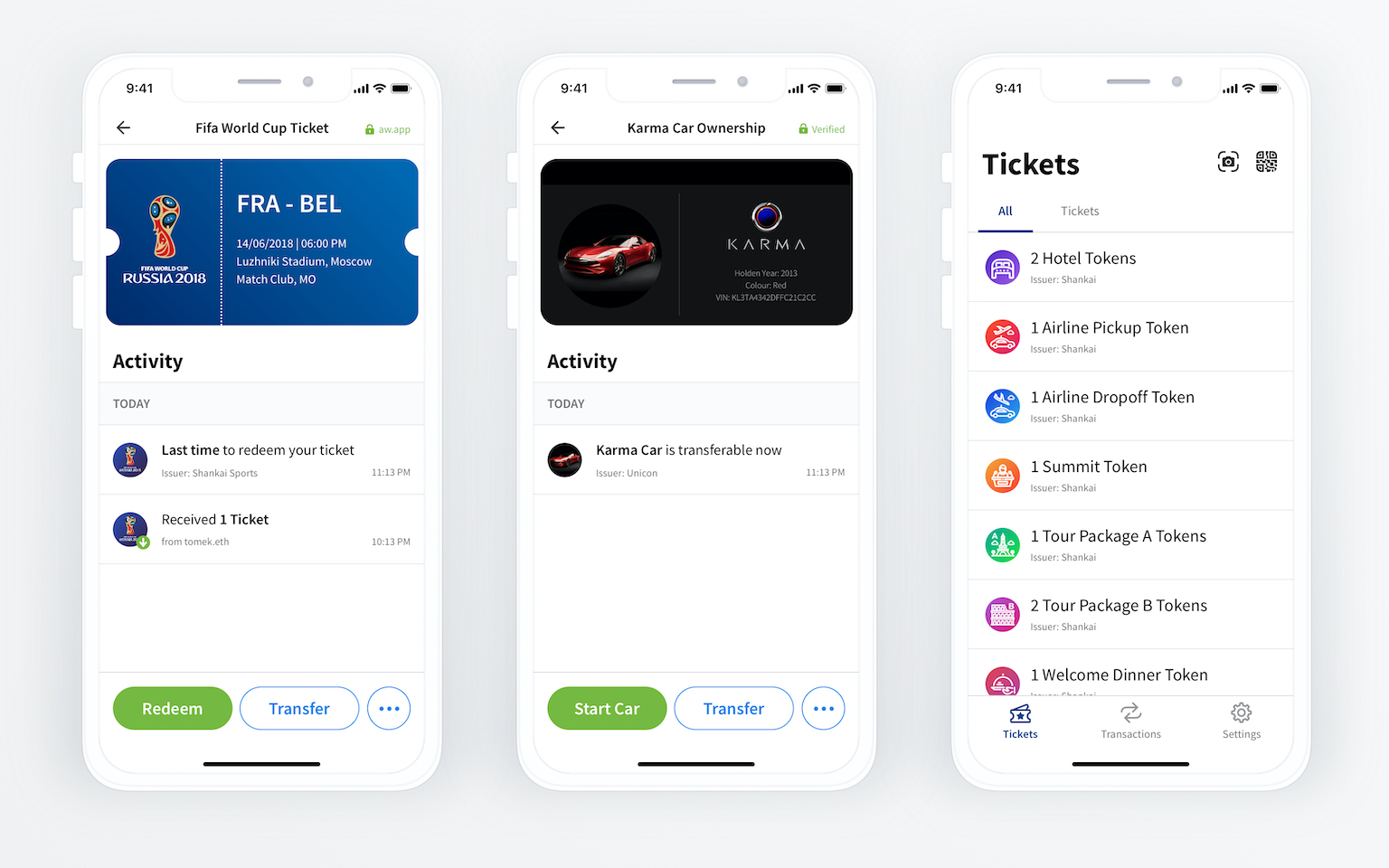

Building a Game of The Throne might be dramatic but we are not seeing how it is useful to us like the Jet engine is useful. So let’s step to an example with practical use. Suppose you can tokenise your ownership of a car. On a minimum level, it helps you to trade the car. The car ownership can be traded without a middleman to host the transaction. This effectively can turn any car bulletin-board into a marketplace. But, as a token, it also allows many programmable things to be built on it:

- An insurance company will be able to ensure your car without uploading document proofs. Its website should recognize your car token.

- A workshop will allow you to swipe your mobile phone and get a discounted service that comes with your insurance policy, because insurance is a token too, and computers can recognize it.

- If you send your cars to earn money through a car-next-door share-economy, it can be set up with a simple sign-up instead of 4 pages of forms. You can trade your car’s earning capacity in the share-economy too since it is also a token.

- You can apply technologies like Zero Knowledge Proof to prove your ownership over an uninsured, no prior-accident car without giving away which car. Here gone the GDPR because we don’t need it now — we didn’t tell the insurer which car it is at the outset.

Imagine this web3 page as the result of car token. It’s worth noting that the functions on this do not depend on a powerful organisation in the centre to have commercial deals and thus back-end connection to all of the companies involved.

Tokenisation and smart-contracts are like the interior and exterior of the same concept. But the connotation is different. Smart contract sounds restrictive — it is about rules that even a judge can’t overwrite. Tokenisation is to look beyond the restrictive nature of contracts but to look at what is enabled by it. It enables cascading infrastructure to be built on codified contracts. It will enable marketisation and free trade.

What is the Token Economy?

Contrary to popular belief, Token Economy is not a bunch of people play with different tokens in a game of thrones in the hope of getting rich quickly at the cost of others who also want to get rich quickly.

Well, not entirely. HBO’s Game of Thrones show is unfortunately still on at the moment, but it is in its last season, so is the old crypto-economy game of thrones. The eye-catching war of hack and slash (or media misinformation warfare around ICO coins) is a far cry from how smart contracts and blockchain enables the economy. You ado not see the real Token Economy because we haven’t got a working one yet. To understand the token economy, I ask you to suspend your disbelief for a moment and imagine with me.

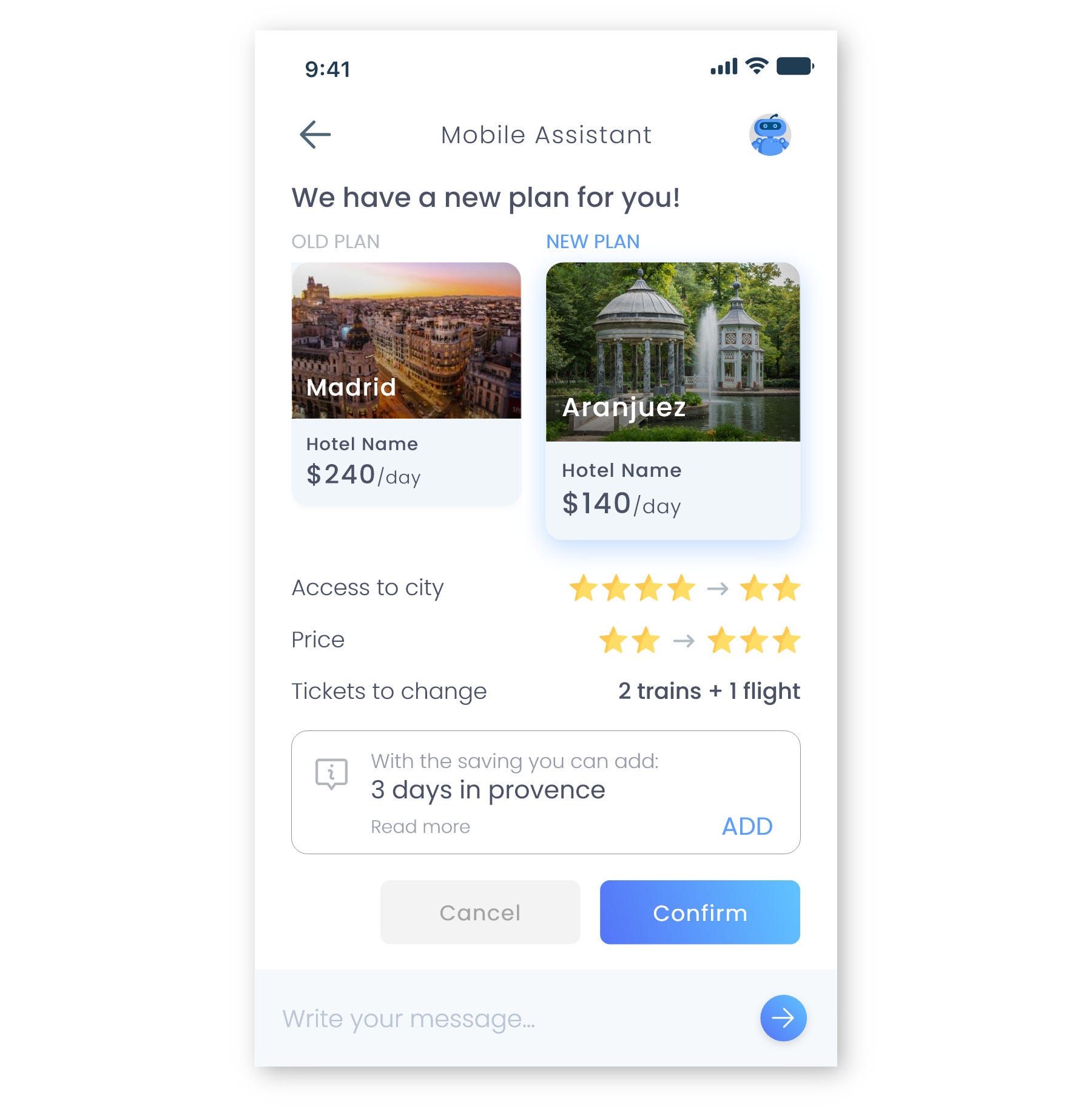

Imagine that you have a travel plan across Europe. You were to stay in Madrid for a few days and have already booked a hotel. Then, Madrid hotel price surged for an event you weren’t interested in. Your mobile assistant notifies you this:

How is it possible for your hotel booking to be sold easily, and how does your mobile assistant gets you the market information? What about the reselling and reacquiring of the tickets due to the change of plan? That would take a day of research and form-filling. The answer is since all are tokenised, all can be automated and happen in an instance.

Even better still, since tokenisation depends on the crypto keys in your wallet, all these operations do not require you to delegate the trust to a big mobile assistant company like Amazon or Google. Your mobile phone can do it locally by signing off transactions.

Now coming back from our imaginary token economy to reality, our current hotel bookings are not tokens, so we need to introduce a 3rd party to do this magic. The current going solution is to delegate finance, identity, travel plans all into Amazon, and hope that it works on our interest, not on the shops and agents who are also Google partners.

See the difference of the tokenised, decentralised web3 world and the current world in which, for the lack of tokenisation, a giant all-mighty 3rd party is needed and is thus propped up to the pedestal of the world’s largest company.

More on Blog